Bitcoin Hits $57.1K, Eyes Correction Amid Market Heat

In A Nutshell

Bitcoin has recently witnessed a significant breakout, surpassing the $55k mark, a movement underpinned by a combination of bullish market sentiment and strategic acquisitions by major players like MicroStrategy. However, despite the positive momentum, market analysis suggests a potential retrace to the $53.5k level in the near term due to an overheated market on lower timeframes and an imbalance in liquidation levels.

The Surge Beyond Expectations

In an impressive display of market strength, Bitcoin broke out of its twelve-day trading range, reaching a local high of $57.1k. This surge was bolstered by news of MicroStrategy’s acquisition of an additional 3000 BTC, alongside significant capital inflows into Bitcoin ETFs. Crypto analyst Ali Martinez highlighted the $57.1k level as a critical resistance point, a prediction that materialized but with a stronger move than anticipated.

Market Dynamics and Indicators

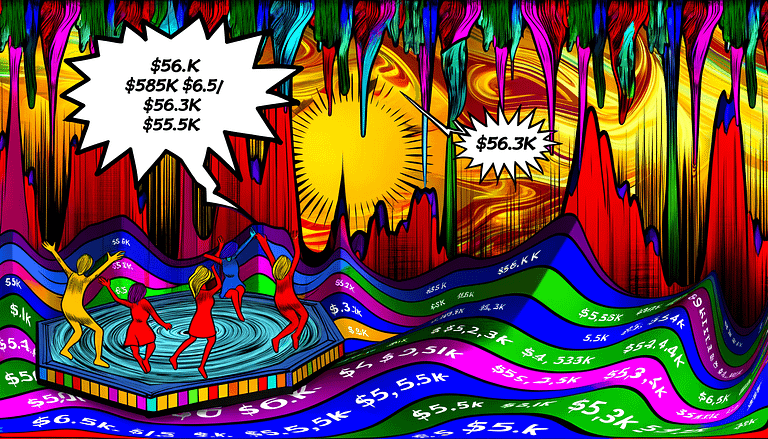

The recent bullish activity has sparked a substantial increase in the Relative Strength Index (RSI) and On-Balance Volume (OBV), indicating overbought conditions and significant buying volume, respectively. Furthermore, an analysis of Open Interest and spot Cumulative Volume Delta (CVD) from the futures markets reveals a marked increase in speculative activity, suggesting potential for further gains.

Overheated Market Concerns

Despite the bullish trend, there are concerns regarding the overheated nature of the market on lower timeframes. The Cumulative Liquidation Levels Delta has shown a significant imbalance, favoring long liquidations. This imbalance suggests a likely retrace to the $53.5k level to balance the market, with the $52.4k level serving as a potential buying opportunity upon retest.

Our Take

The recent breakout beyond the $55k mark signifies a strong bullish momentum within the Bitcoin market, driven by strategic acquisitions and investor optimism. However, the imminent correction to the $53.5k level represents a natural re-balancing of the market, serving as a crucial reminder of the volatile nature of cryptocurrency investments. Investors should exercise caution and consider this a potential opportunity to reassess their positions in anticipation of future market movements.

Sources:

– Ali on X (formerly Twitter)

– BTC/USDT on TradingView

– Coinalyze

– Hyblock

– AMBCrypto