Cardano’s Dip Sparks Hope for Future Rally

In A Nutshell

Recent developments have raised questions about Cardano’s (ADA) performance amidst a bearish trend in the cryptocurrency market, particularly with Bitcoin (BTC) experiencing a significant drop. Despite ADA’s recent slump, there remains optimism based on historical data which suggests a potential bull run for Cardano, possibly leading it to achieve a new all-time high (ATH).

Cardano’s Current Market Position

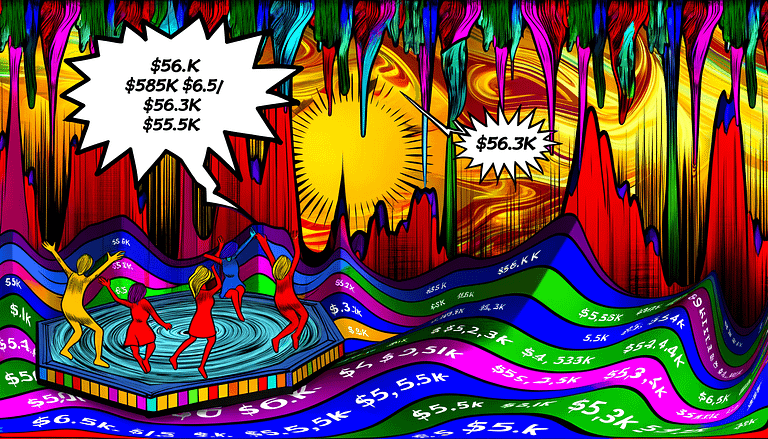

Over the past week, Cardano has seen a decrease of more than 12% in its value, with a further 3% drop in the last 24 hours alone. This decline has placed ADA’s trading price at approximately $0.5666, ranking it as the 9th largest cryptocurrency by market capitalization. The bearish trend in Bitcoin has been identified as a major influencing factor, causing a ripple effect across the crypto market. Analysis of sentiment and social volume data from Santiment indicates a dominant bearish sentiment among investors, despite ADA’s sustained popularity.

Possible Turnaround for Cardano

An interesting historical pattern has been highlighted, showing that ADA previously reached its ATH 90 days after Bitcoin achieved its ATH. With Bitcoin recently hitting $73k, speculations arise about whether Cardano might follow suit with a bull rally. On-chain metrics such as ADA’s MVRV ratio and its network-to-value (NVT) ratio suggest potential for a trend reversal, indicating undervaluation and a bullish future. However, technical indicators like the MACD, Money Flow Index (MFI), and Relative Strength Index (RSI) currently suggest bearish momentum.

Technical Analysis and On-Chain Metrics

Despite prevailing bearish indicators, the analysis of certain on-chain metrics offers a glimmer of hope for Cardano. The MVRV ratio, for instance, is notably low, which historically has been a precursor to price reversals. Similarly, a decrease in the NVT ratio often signals that an asset is undervalued, potentially heralding a price increase. These insights suggest that while immediate indicators are bearish, underlying metrics provide a more optimistic outlook for ADA’s price trajectory.

Our Take

The cryptocurrency market is notoriously volatile, making predictions particularly challenging. However, the combination of historical data and current on-chain metrics for Cardano presents a compelling case for cautious optimism. While technical indicators might currently reflect a bearish sentiment, the potential for a trend reversal, as suggested by the MVRV and NVT ratios, cannot be ignored. Investors should closely monitor these developments, understanding that the market can shift rapidly. Ultimately, the possibility of ADA achieving a new ATH in the near future remains plausible, albeit dependent on broader market trends and investor sentiment.

—

**Sources:**

– Santiment

– CoinMarketCap

– TradingView