The Psychology of Investing in Cryptocurrency

Embarking on a journey through the bustling Cryptocurrency Market demands an understanding of the intricacies of Investor Behavior and the nuances of Trading Psychology. Digital assets, particularly cryptocurrencies, have emerged as a dominating force, offering both heightened excitement and considerable challenges to investors. The phenomenon of Bitcoin and other cryptocurrencies is more than just a technical marvel; it’s a psychological adventure, marked by the allure of innovation and the powerful dynamics of human emotions in the face of volatility.

As the debate over cryptocurrency’s validity as a sustainable financial instrument continues, it is vital to recognize the psychological layers that influence investment choices within this arena. From the adrenaline rush of witnessing value fluctuations to the irresistible ‘fear of missing out’ (FOMO) phenomenon, the crypto landscape is as much about psychological warfare as it is about financial acumen.

Key Takeaways

- The psychology of cryptocurrency investing goes beyond simple market dynamics, incorporating FOMO and the allure of rapid wealth.

- Investor behavior in the crypto realm is heavily influenced by the volatile and unpredictable nature of digital assets.

- Understanding the psychological impact of trading is crucial for navigating the cryptocurrency market effectively.

- Trading psychology must be considered alongside technical analysis to develop a comprehensive investment strategy.

- Educating oneself about the psychological triggers within the cryptocurrency space can lead to more informed, rational investment decisions.

- An awareness of the common psychological pitfalls can help investors manage their expectations and investment approach in the cryptocurrency market.

Understanding Cryptocurrency: A Digital Phenomenon

The advent of cryptocurrency has ushered in a revolutionary approach to understanding value and redefined what constitutes an investment. At its core, these digital assets embody a new frontier in financial markets, where investment strategy and technological innovation converge. The dynamism of cryptocurrency markets has captured the attention of both seasoned investors and the curious onlooker, marking it as not just an innovation, but a cultural phenomenon.

The Unique Nature of Crypto as an Investment

Cryptocurrencies diverge significantly from traditional investment avenues such as stocks, bonds, or real estate. Unlike these assets, digital currencies serve a dual purpose: facilitating digital transactions as a medium of exchange while also providing the potential for speculative investment gains. This unique characteristic has expanded their appeal well beyond conventional investment circles to a much broader demographic embracing the digital age.

Blockchain Technology: Securing Crypto Transactions

The bedrock of cryptocurrency’s allure is the groundbreaking blockchain technology that ensures the security and integrity of digital transactions. It’s the ironclad ledger system that has won the trust of individuals and corporate giants alike, with industry leaders such as AT&T and Burger King already adopting cryptocurrencies as a viable payment method. With blockchain, the promise of expedited and safer digital transactions becomes a reality, paving the way for a cashless future.

In the matrix of cryptocurrency markets, investment strategy is not just about buying low and selling high; it’s about understanding the intricacies of digital assets and the technology that underpins them. This strategic comprehension positions investors to capitalize on the volatile but potentially lucrative nature of these digital assets.

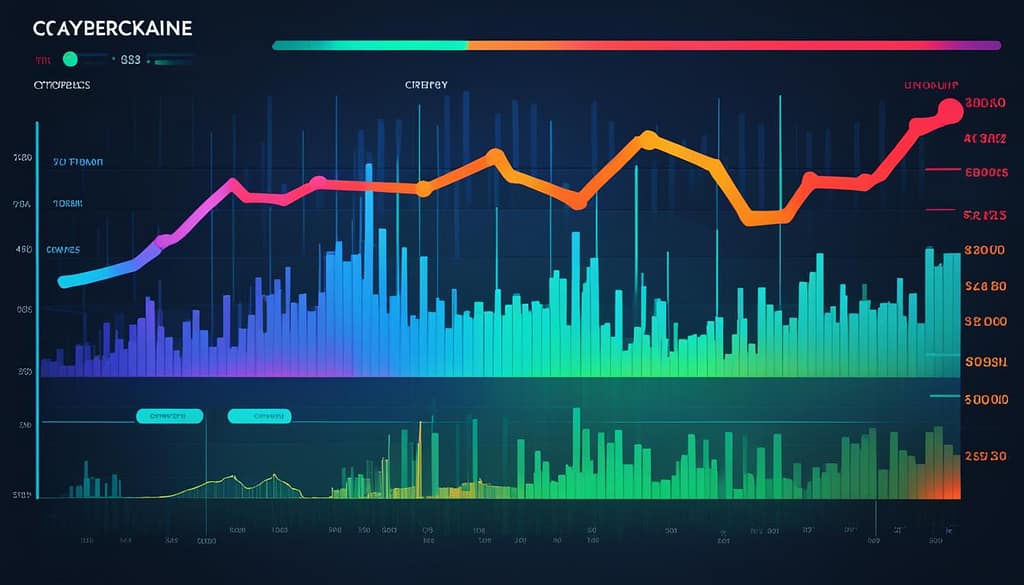

The Volatile Nature of Crypto Markets

Within the digital finance realm, crypto volatility stands out as a fundamental characteristic, weaving a complex pattern of risk and reward that directly impacts investor psychology. The sweeping tides of the cryptocurrency markets can often resemble the ebb and flow of oceanic waves, unpredictable and forceful, challenging the nerves of the most seasoned investors.

The erratic movements in the value of digital currencies can mirror the dizzying lights and sounds of a casino, where fortunes are made and lost in the blink of an eye. This financial rollercoaster captures both the daring spirit and the cautionary tales that fuel countless discussions about the cryptocurrency market’s nature.

“Cryptocurrency investment is not for the faint of heart, and it demands a robust strategy to navigate its ups and downs.” – An observation often shared among experienced crypto investors.

The influence of extreme market fluctuations on the behavioral patterns of investors is profound. Here some have found opportunity amidst chaos while others have succumbed to the psychological weight of tumultuous market conditions.

| Crypto Asset | Volatility Index | Typical ROI | Investor Sentiment |

|---|---|---|---|

| Bitcoin (BTC) | High | Potential for significant gains | Mixed, from extreme optimism to cautious skepticism |

| Ethereum (ETH) | Medium to High | Steady growth with bouts of rapid increase | Generally positive with attention to platform development impacts |

| Ripple (XRP) | Medium | Lower gains, subject to legal outcomes | Uncertainty due to ongoing legal proceedings |

The table above illustrates the diversity of volatility and potential returns across various cryptocurrencies, but more importantly, shines a light on the intricate relationship between perceived value and investor psychology. The appetite for risk, driven by narratives of outsized rewards, is a testament to the human pursuit of growth in face of uncertainty—a dance with the digital economy’s shifting sands.

- Bitcoin continues to lead the market with its high volatility and equally high potential for returns, drawing a legion of investors ready to stake their claims on digital gold.

- Ethereum’s promise of functional innovation beyond a store of value adds layers to its market movements, as investor sentiment can be swayed by the arrival of new decentralized applications.

- Ripple’s journey through the finances and courts paints a complex picture of risk, where legal judgments can pivot the foundation of investor confidence.

In essence, the crypto market is one that perpetually tests the balance between the trembling hands of risk and the outstretched arms of reward. Investor psychology is continuously molded by these elemental forces, crafting narratives that resonate well beyond the charts and graphs of market analysts.

Why Fast Wealth Attracts Investors to Cryptocurrency

The pursuit of wealth accumulation through crypto investment has become a defining feature of modern finance. Unlike the steady approach inherent in traditional assets, cryptocurrencies offer a fast track to potential riches, making them particularly attractive to individuals with a penchant for risk-taking behavior.

The Appeal of Quick Riches in Risky Assets

Investors captivated by the quick gains associated with cryptocurrencies often exhibit a distinct risk-taking behavior, which parallels gamblers’ thrill-seeking traits. The volatilities of the crypto market amplify the prospect of rapidly multiplying an investment, positioning digital currencies as a magnet for those inclined to gamble on their financial future.

Comparing Traditional Investments and Crypto Earnings Potential

Legions of investors, traditionally accustomed to the incremental growth of stocks and bonds, now gaze upon the crypto landscape where double-digit returns are not just a possibility, but a reality for some. While the risks are undeniable, the lure of turning modest inputs into substantial wealth is an irresistible siren call for many.

- Traditional investments, characterized by well-researched patterns and predictable outcomes, often fall to the sidelines when rapid growth is on the horizon with cryptocurrencies.

- Crypto investments, meanwhile, have birthed narratives of overnight millionaires, compelling investors to place bets on digital assets with the hope of joining the ranks of those who have reaped exceptional rewards.

- The burgeoning industry of DeFi, or decentralized finance, also taps into this desire, enabling novel ways of asset accumulation through mechanisms unfathomable in the realm of traditional finance.

This paradigm shift towards cryptocurrencies as a vehicle for rapid wealth is a testament to the changing face of investment and the human inclination to seize opportunities for swift financial success, even at the risk of potential downfall.

The Lure of Technological Innovation for Investors

The dawn of cryptocurrencies marked a radical shift in financial paradigms, intertwining economic speculation with Technological Advancements. At the vanguard of this revolution, Crypto Pioneers like Bitcoin disrupted traditional transactional frameworks, seducing a new wave of visionary investing.

Bitcoin’s contribution to the financial sector isn’t merely one of economic significance; it is a historical leap in the application of blockchain technology. This has captivated investors who are not just seeking financial returns but are also enthused by the prospect of contributing to the proliferation of a ground-breaking tech ecosystem.

Blockchain Pioneers: Bitcoin and the Cryptocurrency Evolution

Bitcoin’s ascendance to mainstream notoriety is emblematic of the transformative potential of innovative tech. The meticulously constructed blockchain stands as a testament to secure and rapid transactions, qualities that had been merely aspirational before its conception. Such advancements resonate deeply with those wanting to be at the bleeding edge of technological progress.

Investing in the Future: The Technophile’s Attraction to Crypto

The overarching theme of crypto is not just its immediacy as a financial instrument but also its latent potential. Enthusiasts and savvy investors recognize this, seeing beyond the volatile market swings to the bedrock of opportunity laid by inexorable technological advancements.

| Technology Aspect | Traditional Banking | Cryptocurrency |

|---|---|---|

| Transaction Speed | Days for international | Minutes to hours |

| Security Features | Centralized databases | Decentralized, cryptographic ledger |

| Innovation Quotient | Incremental updates | Rapid, ground-breaking advancements |

| Investor Appeal | Stability and tradition | Technological edge and future potential |

In the nexus of innovation, cryptocurrencies stand proud, weaving a narrative that extends far beyond the traditional stock ticker. It embodies the spirit of our era: a relentless quest for innovation, a drive for efficiency, and a shared vision of a decentralized financial future. It is here that the tech enthusiast finds their haven, and the investor locates their frontier.

The Impact of Success Stories on Investor Psychology

The cryptocurrency market is a landscape filled with tales of overnight successes and formidable gains, where the allure of becoming one of the fabled crypto millionaires beckons globally. As these anecdotes proliferate, they do more than entertain—they actively shape investment decisions, sometimes to the detriment of a balanced understanding of the market’s reality.

The Role of Anecdotes in Shaping Investment Decisions

Success stories are compelling narratives that can skew perception and drive actions within the investment community. They have the power to transform hesitancy into eagerness, caution into audacity. The influence of hearing about a friend’s significant returns or reading about a stranger’s windfall on a forum can’t be underestimated. The psychological trigger these stories set off often leads to Fear Of Missing Out (FOMO), a prevailing force in today’s investment world.

Assessing the Probability of Success in Crypto Investments

While success stories dominate headlines and social feeds, they may not always be indicative of the average investor’s experience. For every tale of extravagant earnings, there are countless untold stories of loss and hardship. The lopsided visibility of success stories thus creates a distorted view that can lead to overestimation of the probability of becoming one of the elusive crypto millionaires. Critical and unbiased analysis, mindful of survivorship bias, is essential when navigating investment decisions in the volatile crypto market.

Fear of Missing Out (FOMO) Driving Market Cycles

Within the intricate web of market dynamics, FOMO Psychology is a fascinating force that churns the tides of crypto trading. This powerful aspect of investor behavior pushes the market into a tumultuous journey of peaks and valleys, as traders are driven by a potent fear of losing out on possibly lucrative deals. The phenomenon of FOMO acts much like a catalyst for the emotional reactions that accelerate buying frenzies, ultimately swelling market valuations in a sometimes unsustainable bubble.

The intricacies of FOMO are not solely about greed; they reflect a deep-seated human instinct to participate in the wisdom of the crowd, hoping to reap benefits from burgeoning market trends. The impact of FOMO is particularly evident within the cryptosphere where information travels at light speed, and prices can skyrocket in response to a mere whisper of potential gains. Decisions become less about calculated risks and more about the emotional pull of potential opportunities that seem too golden to pass up.

Market cycles fueled by FOMO can be charted with an almost rhythmic predictability, as waves of investors rush to join the financial bandwagon, propelled by the success narratives of those who have struck it rich. In trying to avoid being left behind, investors often discard their long-term strategies for the immediate gratification of ‘joining the party’, further exacerbating the market’s volatility.

The market often reflects the sum of our collective psychology, and nowhere is this more true than in the realms of crypto trading, where FOMO can blur the line between rational strategy and emotion-driven impulse.

However, what is vital to recognize is that, as FOMO drives prices up, it also sets the stage for potential corrections. When reality catches up, and the momentum fueled by fear of missing out wanes, the market can witness rapid declines as investors rush to liquidate their positions. Understanding this psychological undercurrent is crucial for investors who wish to navigate the turbulent waters of crypto trading without falling prey to the whims of mass sentiment.

- Identify patterns of FOMO-induced market spikes

- Analyze the long-term impacts on investment strategies

- Develop awareness of personal susceptibility to FOMO

- Create plans to mitigate emotional decision making

By incorporating this knowledge of FOMO psychology into their strategy, investors can potentially temper their responses to market dynamics, striving for decisions rooted in analysis rather than the contagious excitement of the crowd.

Understanding Investor Psychology When Facing FUD

The crypto markets are notably affected by a psychological phenomenon known as FUD (fear, uncertainty, and doubt). This trifecta of emotional responses can trigger abrupt decisions among investors, often leading to a chain reaction of sell-offs which destabilizes the market. Delving into the FUD impact reveals a landscape where emotional trading can have just as much influence as economic indicators or technological innovation.

Emotional trading is a critical factor to consider, as it often overrides rational analysis and can precipitate either rapid growths or drastic declines within crypto markets. Investors, blinded by the immediate impacts of FUD, may ignore long-term trends and analytical forecasts, leading to regrettable investment outcomes. The ability to manage one’s emotions, particularly in the volatile sphere of cryptocurrencies, emerges as an essential skill for successful trading.

Understanding the psychological drivers behind FUD is paramount for investors who aim to remain calm and collected in the face of market turbulence.

An in-depth look into the events impacting the crypto market can help illustrate the power of FUD.

| Event | Market Reaction | Emotional Cue |

|---|---|---|

| Rumours of Regulation | Negative market sentiment, price drop | Fear |

| High-profile Hacking Incidents | Loss of investor confidence, sell-offs | Uncertainty |

| Competing Cryptocurrencies’ Emergence | Market fragmentation, investment shifts | Doubt |

Investors keen on mitigating the FUD impact on their portfolios are often advised to adopt a long-term perspective and focus on the underlying value rather than momentary fluctuations. In essence, recognizing the signs of emotional trading can be an investor’s best defense against the reactionary impulses that FUD incites in the crypto markets.

Psychological Traps and Biases in Cryptocurrency Trading

In the highly speculative arena of cryptocurrency trading, Trading Psychology plays a pivotal role in shaping the investment landscape. Traders’ actions and market trends are often the manifestations of underlying Cognitive Biases that can distort rational decision-making and influence one’s Investment Strategy. Recognizing these biases is the first step towards building a more resilient approach to cryptocurrency investing.

The Dangers of Confirmation Bias and Anchoring

Confirmation bias drives traders to favor information that aligns with their existing beliefs, creating a feedback loop that reinforces their initial stance. This psychological shortcut can result in overlooking contradictory evidence, crucial in dynamic markets like cryptocurrency. Similarly, the anchoring effect can cause investors to rely too heavily on the first piece of information—such as an asset’s past price—when making decisions, which could be detrimental to the assessment of current market conditions.

Behavioral Pitfalls: Overconfidence and Herd Mentality

Overconfidence in one’s trading ability can lead to riskier investments, under the assumption of being immune to losses that others experience. Coupled with the herd mentality, where the fear of missing out on seemingly profitable trends causes investors to mimic the actions of the majority, this can dramatically escalate market volatility. Such collective movement can be potent, but also perilous, leading to inflated asset prices or sudden crashes.

| Cognitive Bias | Impact on Trading | Risk Mitigation Strategies |

|---|---|---|

| Confirmation Bias | Ignores opposing market indicators | Seek diverse sources and perspectives |

| Anchoring | Dependence on historical data hindering current assessment | Consider a range of timeframes and data points |

| Overconfidence | Excessive risk-taking | Implement strict risk management rules |

| Herd Mentality | Fuels market bubbles and crashes | Conduct independent analysis |

To evade these psychological pitfalls, educating oneself on market analysis and diversifying investment portfolios can provide a more level-headed approach to trading, allowing for a balanced reaction to market shifts and the avoidance of emotionally-driven decisions. Ultimately, success in cryptocurrency trading hinges on striking a delicate balance between psychological intuition and methodical, data-based strategy.

Conclusion

The expedition through the psychological landscape of cryptocurrency investing highlights the necessity for astute investment practices and the role of investor education. A multifaceted understanding of how emotional factors like FOMO and the allure of rapid wealth can maneuver investor behavior points to the need for a well-rounded crypto strategy. Ensuring the adherence to smart investment practices is not merely a suggestion; it is an imperative for the modern investor seeking to navigate the waves of the digital asset market.

Strategic Approaches to Cryptocurrency Investing

Adopting strategic approaches to cryptocurrency investments necessitates a balance between enthusiasm for new technologies and prudent risk management. It is through this equilibrium that investors can protect their capital while still benefiting from the growth potential of digital assets. Recognizing the patterns in investor psychology and applying this awareness to trading tactics, can empower individuals to make decisions that reflect both their financial goals and market realities.

Educating Investors for Better Decision Making

Garnering a more profound comprehension of market influences and psychological undercurrents equips investors with the armoury to make judicious choices. Investor education stands as a bulwark against the tides of psychological bias and market misinformation. Forums, seminars, and educational content curated by seasoned market analysts aim to develop an informed investor base that can eschew impulse for analysis when plotting their crypto strategy. Embracing education paves the road to not only more informed decisions but also to fostering resilience in the ever-evolving cryptocurrency landscape.